The Trade Promotions (TPx) market has great potential to transform commercial teams’ work. Expected to grow at 10.9% CAGR over the next 5 years, this industry has a long way to go. This article will clarify TPx and discuss its trajectory, potential changes and possible disappointments.

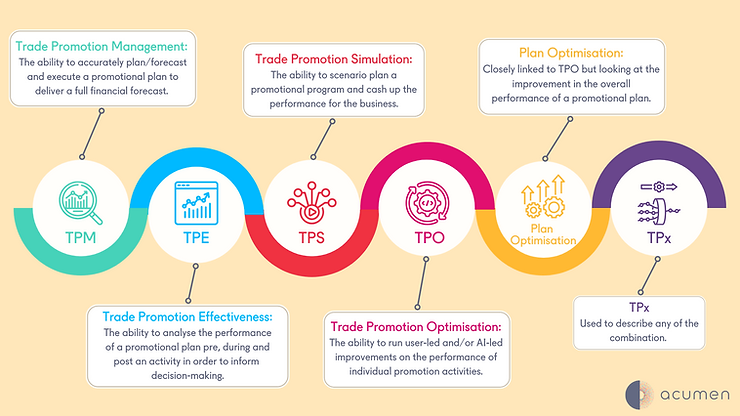

First, I will clear up some acronyms that you may have heard people talk about and attempt to define them clearly in the infographic below:

Hopefully that helps with some of the phrases you may have been hearing and whilst there is no dictionary definition (yet!), at Acumen, this is how we talk about the industry.

Moving forward, I’ll discuss 4 trends that could transform TPM in the next decade.

1. The tech we use will need to continue to change in such a dynamic industry

Post-pandemic trends continue to change the landscape of the industry and put bricks & mortar retailers under more threat than ever. With channel shifts and new routes to market, the technology that organisations use needs to reflect the different ways in which different channels trade. Growth in E-commerce will require real-time TPM with hourly granularity to analyse the effectiveness of specific activities in the digital shelf. In emerging markets, as the trading environment of the market matures, big retailers get bigger, the share of modern trade/key accounts increases and the number of key accounts that hold the most share gets smaller.

The ability of TPM to manage both a general trade business in terms of ex-distributor demand management versus the complexities of a highly sophisticated modern trade customer (and the demands that they come with) is paramount. TPM systems will need to be able to manage multiple business units within a single instance (tool) as the separation of and potentially role of channels may be widened.

2. People will start to use a single solution in multiple markets and see greater collaboration with retailers

There are a few elements to this in terms of how systems are built to deliver benefits to organisations:

Single solution in multiple markets

More and more organisations are moving to more centralised/regionalised IT strategies. This inevitably means that the purchasing power of organisations will be stronger at the global/regional level. As cost price inflation is set to continue and budgets are being cut, we anticipate that more organisations will look to employ a multi-market TPM approach with a single instance that can be used across multiple markets. This will come with challenges as often even neighbouring markets trade in completely different ways, so collaboration between local teams and regional strategy will be more important than ever. Regional TPM implementation/strategy playbooks are becoming more and more commonplace, whilst purchasing decision remains at a local level.

I think, realistically, the strategy that people will choose is to have local TPM providers, with needs tailored best to the specific market (including implementation support, language, and in-market expertise) and then use central data lakes to pull together and centralise the TPO process through a single solution.

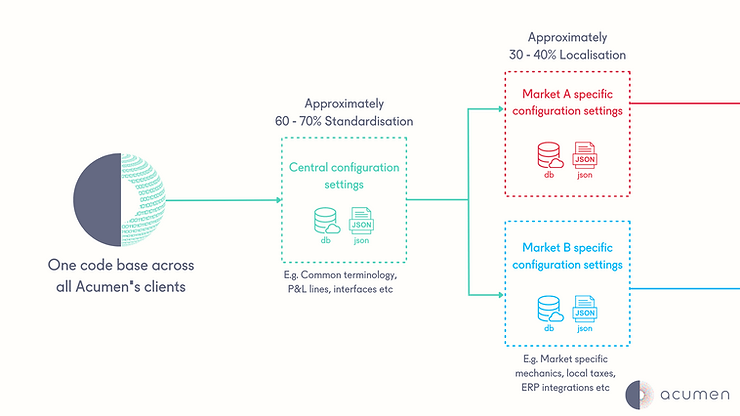

We have been working with a Consumer Packaged Goods (CPG) organisation recently that talks about local decisions, regionally enabled. Ultimately, the regional teams decide which software best supports their global strategy and then sell it to markets, so the decision still sits within the market. We have also worked with a global drinks organisation and created a central system that meets 70% of the needs of their markets (consistent P&Ls for example) whilst leaving 30% of the system to be localised to specific market dynamics.

Greater collaboration with retailers

We are a long way off this but, eventually, there may be a time when it makes sense to remove buyers and account managers in the procurement and planning process and replace them with a single piece of technology that does both and finds a plan that works for both parties, truly delivering a triple-win every time. Organisational structures and ways of working are way too engrained for this to be a short-term reality but, if the technology is there, it’s still a very interesting thought, one that could only be made a reality if there were a lot more trust and collaboration between supplier and retailer.

Now, replacing the sales team with AI is a message that no one wants to hear and is, quite frankly, unrealistic – the more realistic view will be discussed in the next section.

3. AI is here to stay and change the way we think but might not be the silver bullet we hoped

Who hasn’t been asking questions or talking about AI in the past 2 years? With more data produced in the last 2 years than in the last 20 years, we need to use advancements in technology to understand it and support commercial teams in delivering win-win plans with retailers.

Practicability of AI

For those familiar with the Gartner Hype Cycle, we are right at the peak of inflated expectations around AI in this area (if you’re not familiar, google it). People speak of AI as the silver bullet which will end all woes. You would be amazed at the number of people we speak to who “want AI” without really knowing what problem they are trying to solve. It’s unrealistic to expect AI to be a silver bullet with the nature of the buying landscape that exists between suppliers and retailers. AI is brilliant and, with constraints, can help get to what the right promotion or the right plan may be, but the input into those models is paramount and the models will still need commercial validation.

I see the key role of the account manager changing with tech enablers, taking outputs/ suggestions from AI models and validating the commercial reality of that plan, but also being a key stakeholder in managing the constraints of the model (e.g. if certain retailers only run specific mechanics, there is no point suggesting others).

AI and TPx

The rise and success of ChatGPT have been another one that is hard to miss, with tech gurus coining that engineers may not exist in 10 years’ time and that product managers will be the most sought after roles in the industry – It’s likely another product of inflated hype, but the technology is incredible. Many TPM solutions today offer pragmatic chatbots that help account managers understand elements of their plan (e.g. “Which mechanic delivers the highest ROI?”) through simple search algorithms and language detection.

The use of this in TPx will likely be to “if I run X instead of Y, what will the results be?” and to deliver real time analytics to show you the scenario – this is all part of the TPS pillar. The chat can also work the other way, logging in to a system and having a bot tell you “Your competitor is running X in this retailer – why don’t you try Y”, all based around some constraint-based modelling, allowing quick and easy decision making.

For example, in recent conversations with a global snacking organisation, they were looking for a bot which could build all of their customer plans for them – our big challenge here was that they wouldn’t have key account teams left if there was really a system that could do that effectively.

What I don’t particularly buy into is the idea of an AI model creating an entire forecast with little human intervention – where we have seen this fail is in the accountability of the sales team. If the bot has created the forecast, accountability immediately sits with … well, no one. Hitting budget and keeping retailer relationships positive is suddenly no one’s responsibility, so I am hesitant to recommend this approach or see it driving significant change in the industry. As mentioned previously, the role of the Key Account Managers (KAMs) will evolve dramatically over the next 10 years. Is your organisational capability set up to manage this transition?

4. The role of KAM will continue to evolve and your technology needs to be an enabler, not a blocker

The final area of discussion is not about the technology itself but about the user of the tool. Within tech companies, you may hear people talking about PICNIC (problem in chair, not in computer), an old gag that rings true for systems all over the world. Whilst the PICNIC analogy may be deflecting blame onto an easy target, the capability gap in account managers will increase significantly as more technology becomes available.

When looking at how TPM can be used within an organisation, we often look at stakeholders based on their role, i.e. KAMs, but, in reality, you have KAMs with different levels of RGM capability and, if we’re honest, KAMs who assign differing levels of importance to RGM.

Now, of course the goal of RGM experts is to get everyone’s RGM capability to increase; however, given the different start points, it’s important that RGM tools can cater for all types of KAMs.

There are multiple ways to look at it but we find it useful to segment KAMs into three segments:

- For RGM Engaged KAMs, your tools need to provide a full suite of post-event ROI analysis, in-flight tracking, margin reporting, predictive volumetric forecasts, scenario models and detailed financial and KPI reporting.

- For RGM Curious KAMs, your tools need to provide a similar suite of functionality, but the paths to outputs need to be simpler, less time-consuming and the outputs better summarised and easier to understand – What you sacrifice in advanced flexibility, you gain in user engagement and adoption.

- For RGM Minimalist KAMs, you need to provide a very targeted set of functionalities which allow them to complete their tasks quickly and efficiently, but their usage is likely to be focused on control elements and forecasting alone.

The reason the segmentation is important is that we need to make sure our tools allow for each type of KAM, so no one is put off and we keep them engaged; then it becomes the role of the RGM teams to move them up the ladder from Minimalist to Engaged and use this simple framework to build specific TPM capability.

Which persona of account manager will thrive with access to new technology and which will sink?

There will need to be a big shift in capability in commercial teams as this new technology becomes available; Hopefully this will result in a more consultative sales process with buyers, as commercial teams can show them how the new technology is able to help both parties.

The question to you is:

How are you ensuring that all personas across the organisation are ready for the technology changes that are around the corner?

Final Thoughts

I hope this article has sparked some thinking around how you can adapt to new trends in the marketplace. If you agree or disagree with anything in this article, I would love to hear your thoughts and your feedback is welcomed. Please feel free to get in touch to discuss your TPM needs or questions.

To learn how to effectively implement TPM, click below to download our TPM guide:

4 steps to deliver a successful TPM implementation

We are a revenue management consultancy and SaaS provider, helping consumer products companies make smarter, more profitable decisions through a combination of pricing, promotions, and mix management. Speak to one of our consultants here to find out how we can help your business make more profitable decisions.